Float Integrates Chainlink Price Feeds to Help Power Leveraged Tokens & Chainlink VRF for On-Chain Randomness

For the last six months Float has been actively building out a new release, Float Arctic. Launched in early December as a testnet version on Polygon Mumbai with a promise to offer more scalable, stable, and flexible markets, Float Arctic is the more powerful and scalable successor to the initial Alpha release. While both Float Alpha and Float Arctic are using Chainlink Price Feeds to power their leveraged tokens, one of the many improvements Arctic makes over Float Alpha is the introduction of fixed epoch price updates.

Chainlink Price Feeds provide Float with reliable price data of popular cryptocurrencies, which in turn allows the protocol to facilitate long- and short-leveraged tokenized exposure.

In Float, users can mint long or short positions across various markets (in a single-click UX fashion) without the risk of liquidation. This is what makes Float unique, it is one of the first projects to offer decentralized leveraged tokens, with user-selectable leverage without risk of liquidation (Note: many other risks still exist).

Chainlink Price Feeds#

Float Arctic utilizes a more innovative price update mechanism, called Fixed Epoch Execution, an improvement that has the same level of security to protect against front-running attacks but offers better predictability of price updates for users and liquidity providers.

All users' transactions (e.g. mint and redeem actions) created in a specific time period (i.e. epoch) are batched together and executed at the same price, using the next spot price update received after the epoch ends plus a minimum execution waiting threshold. The epoch length will imply the generally expected update frequency of the system and therefore predictability of price updates. This offers a better UX as exposure stays constant over that period, thereby making it easier to dynamically manage positions in Float and build trading strategies on top of Float (e.g. delta-neutral hedging).

An additional minimum execution waiting threshold is introduced to thwart the probability of prior knowledge of the price to be used for execution. That is, if a user has knowledge of upcoming prices before they are updated on-chain, they could selectively enter and exit positions on the protocol by placing their transactions before the expected update. Introducing an execution waiting threshold is intended to mitigate this front-running vector.

Float’s mission is to ship innovative financial primitives and drive the evolution of finance. The team is committed to innovating and building a blue chip DeFi protocol, that enables users to get tokenized long and short exposure without the risk of liquidation or capital inefficiency of managing a collateralised debt position.

From launch, through Float Arctic and through our future deployments, we have an ongoing need for high-quality, secure and decentralized pricing data.

"Chainlink is the industry standard for on-chain pricing data. When our users see that we’ve integrated Chainlink Price Feeds, they’ll have peace of mind of knowing there’s one less layer of risk to worry about. In addition, the Chainlink Labs team is incredible to work with. They’re able to help us to support new Chainlink Price Feeds, allowing us to rapidly deploy new markets to meet demand." - Jason Smythe, Co-Founder at Float.

Further integration with Chainlink VRF#

In support of the continued growth and maturation of decentralized infrastructure, Float has now expanded its integration with Chainlink to support secure and transparent on-chain randomness.

In anticipation of Float Arctic, and to celebrate Float’s early users, Float also launched the A.P Morgan Sailing Club, an exclusive invite-only community-focused NFT Collection of 6,900 unique, timeless A.P. Morgans.

“While designing the NFT collection we wanted to give our users the best of both worlds: An NFT that they could personalize, by selecting from a wide range of super cool wearables and accessories to protocol references, AND, verifiably randomised layers that can add depth to the collection and deliver that looks rare factor that is essential for NFT trading. Chainlink VRF provides an easy solution for doing this, which solves the tricky problem of doing on-chain randomness without risk of tampering.” - Campbell Easton, CMO at Float.

Each NFT, or A.P. Morgan, in the Sailing Club is made from seven layers of exquisite pixel art. Five of the seven layers are user-selectable, where users can choose headwear, eyewear, accessories, outfits, and overlays to style their Morgan in the A.P. Morgan Builder before minting.

At mint, two remaining layers (fur and background) are randomly generated on-chain using the power of Chainlink VRF, with the following rarity distribution:

- Common - 50% chance

- Uncommon - 30% chance

- Rare - 15% chance

- Legendary - 5% chance

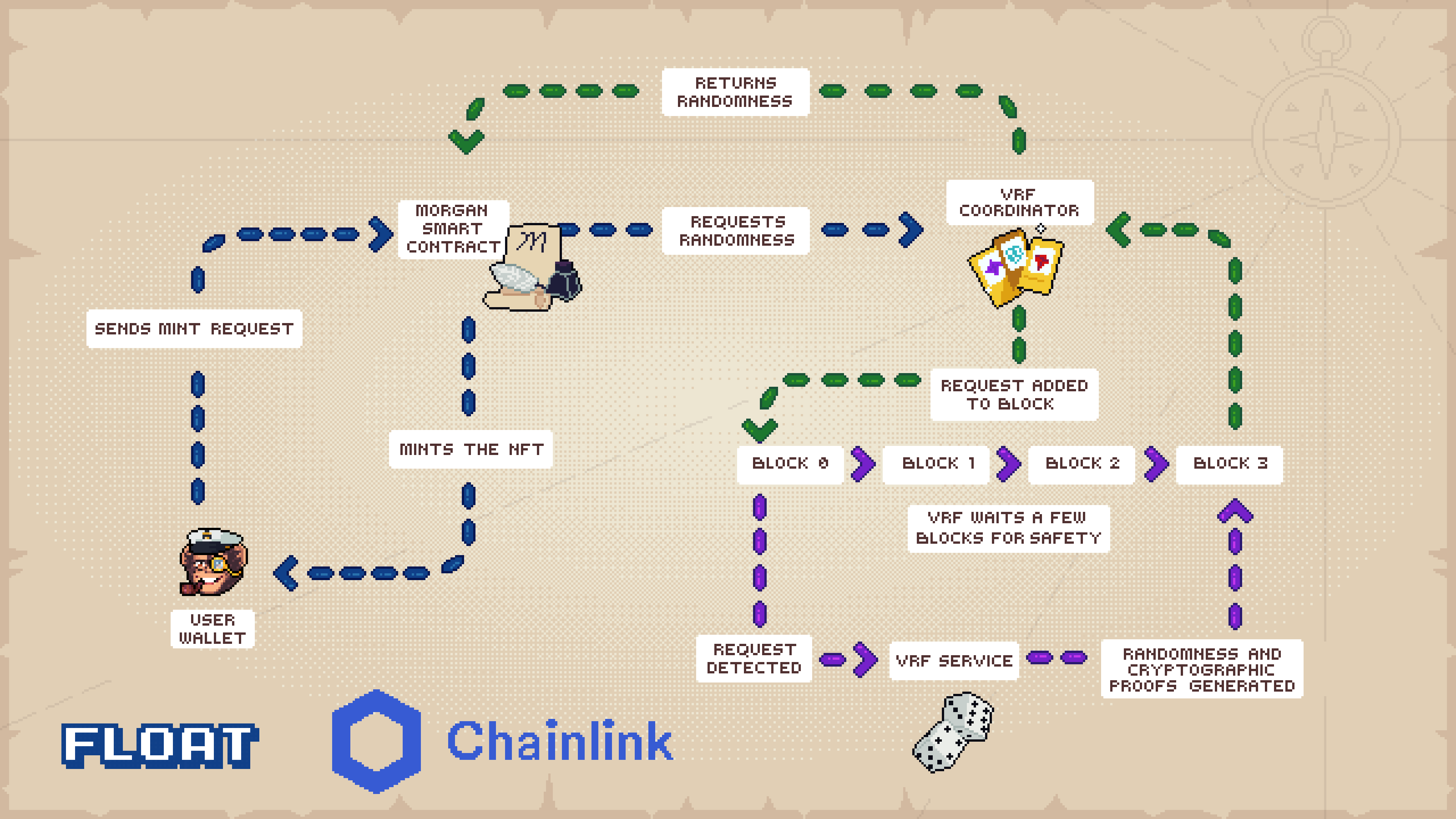

Chainlink VRF is a tamper-proof and verifiable random number generator that enables smart contracts to access random values without compromising security or usability. For each request, Chainlink VRF generates one or more random values and cryptographic proof of how those values were determined. The proof is published and verified on-chain before any consuming applications can use it.

Chainlink VRF works by combining block data that is still unknown when the request is made with the oracle node's pre-committed private key to generate both a random number and a cryptographic proof. The A.P. Morgan Sailing Club smart contract will only accept the random number input if it has a valid cryptographic proof, and the cryptographic proof can only be generated if the VRF process is tamper-proof.

Key results#

“Looking at the composition and statistics of the NFT collection, we can confidently say that Chainlink VRF has worked as expected and that the rarity distributions minted so far are in line with the probabilities assigned to the furs and background. We cannot believe a lucky user minted a legendary fur and a legendary background! There was a 2.5% chance of getting this combination...” - Sven Muller, BD at Float

The A.P. Morgan Sailing Club Collection and personalized A.P. Morgans can be viewed across the respective chains:

Morgan is here#

At mint, each Morgan holder is automatically whitelisted to claim a profile on cutting-edge Web3 social network Lens Protocol, built by Aave founder Stani Kulechov. Morgan holders get to experience a unique UI experience in the Float Dapp, with their Float Profiles automatically having their Morgan set as their Profile Picture.

We’re actively building our presence across the metaverse so that as our users grow, they will be able to take their Morgan with them.

GM no longer stands for good morning. It stands for Good Morgan.

About Chainlink#

Chainlink is the industry-standard Web3 services platform that has enabled trillions of dollars in transaction volume across DeFi, insurance, gaming, NFTs, and other major industries. As the leading decentralized oracle network, Chainlink enables developers to build feature-rich Web3 applications with seamless access to real-world data and off-chain computation across any blockchain and provides global enterprises with a universal gateway to all blockchains.

Learn more about Chainlink by visiting chain.link or reading the developer documentation at docs.chain.link. To discuss an integration, reach out to an expert.

About Float#

Float is the easiest way to get long or short, tokenised exposure to crypto assets, with no liquidations, loans, or collateralised debt positions. Go long or short in one transaction and swap, send or compose your tokenised positions anyway you want.

Float aims to always put trust and security first. Please understand that all DeFi products, including Float, carry significant risk. Do not use Float with any funds that you cannot afford to lose. Beyond our core product we’re constantly working on new, innovative financial primitives. To Float, code is law.