Markets and Pools

Liquidity in Float is deposited into pools, which are grouped into markets.

You can mint tokens by depositing collateral like DAI, or the valueless Arctic Fake Coins into pools.

All the pools which track a certain crypto asset, e.g. BTC, exist within the BTC market, and liquidity moves between them as the protocol receives updated BTC prices via an external oracle.

There are 3 types of pools:

- Long

- Short

- Float

Long and short pools#

These pools are fixed at a specific leverage tier, on a specific side of the market. For example, 3x long ETH will always have 3x long exposure to ETH, except for rare edge cases.

There can be multiple market pools on each side of a Float market i.e. 3 long pools and 3 short pools.

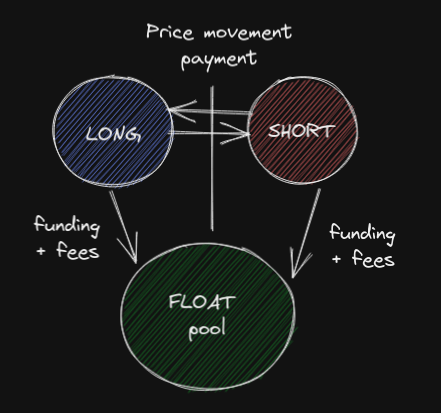

Liquidity moves between long and short pools in line with the movements of the underlying oracle feed.

When the price of the underlying asset goes up, liquidity shifts from short pools to long pools. Conversely, when the price of the underlying asset goes down, liquidity shifts from long pools to short pools.

Float pool#

Each market has another type of liquidity called the Float pool.

The Float pool receives liquidity from market makers, who take the risk of balancing the market in exchange for receiving a funding rate.

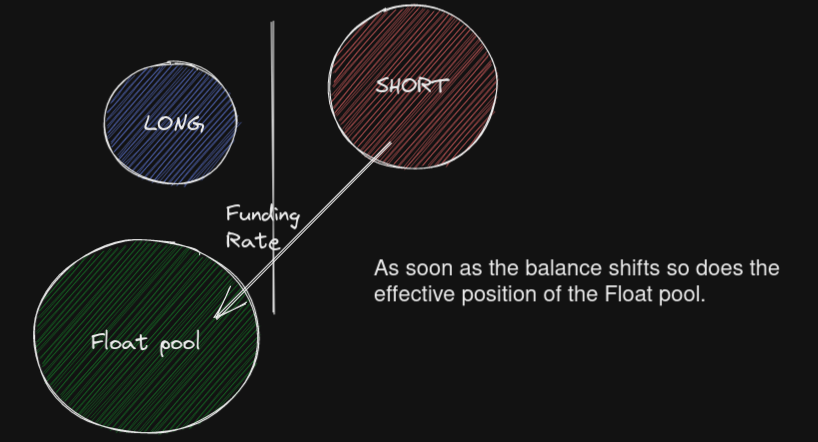

The leverage and position of the Float pool changes based on the balance of capital in the long and short pools.

If there is an imbalance between the long and short pools in the protocol, the float pool acts as the counterparty taking on the required exposure to ensure long interest is equal to short interest.

The example above shows the Float pool taking on long exposure due to excess short liquidity.

The more imbalance between long and short pools the greater the leverage of the Float pool and hence exposure to underlying price movements of the asset.

To protect against extreme imbalances in the market, the Float pool has an upper threshold on the leverage it can be exposed to. When the pool reaches this threshold, the price exposure in the market pools on the overbalanced of the market will drop below 100%.

The Float pool earns a funding rate and stability fees paid by the other pools in the market as an incentive to balance the market.

The funding rate, stability fee, actual liquidity and price exposure of each pool can be seen on the detailed view of that market.