Triggers

For security, actions made in Float Arctic are executed in trade batches. When you make a trade it gets added to a batch alongside all other trades submitted since the last price was received. Trades in this batch will only be executed once the next price is received.

Overview#

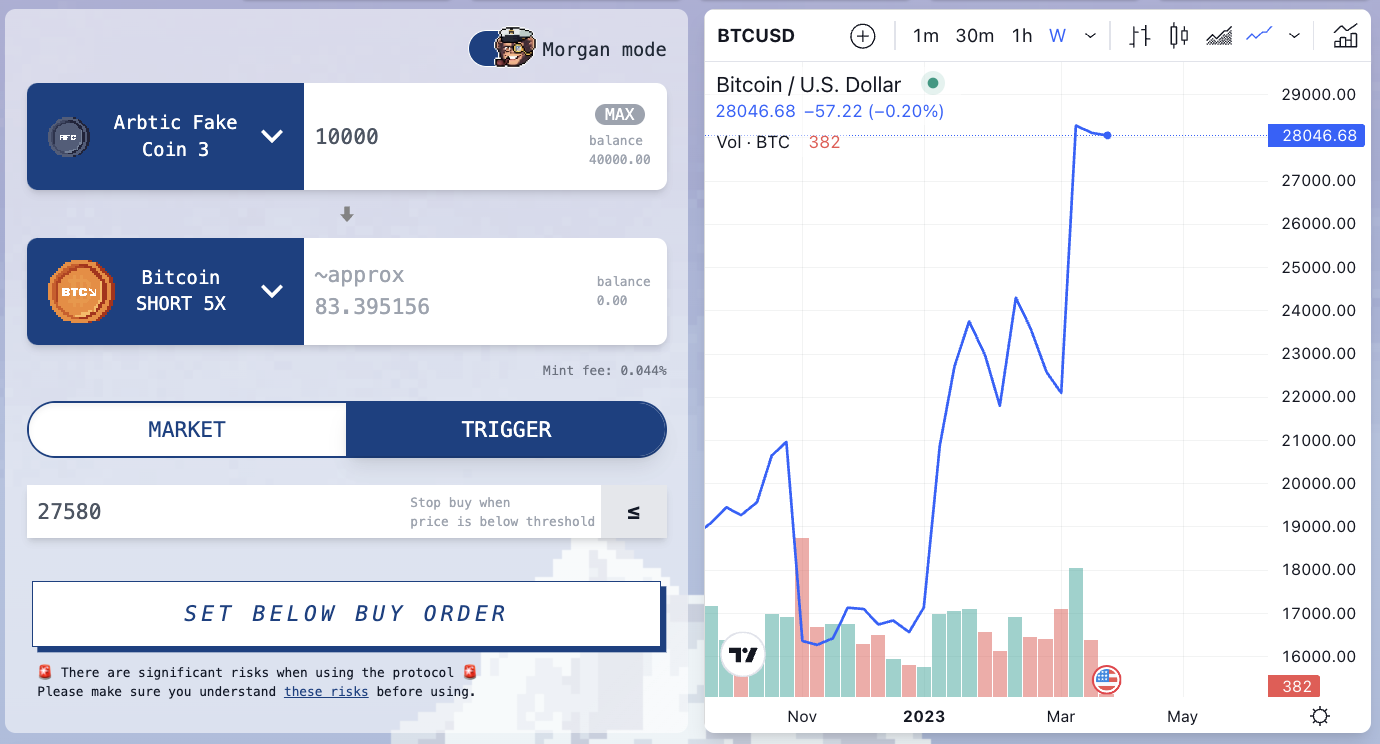

Unlike market orders, which submit your transaction to be executed as soon as possible, triggers allow you to submit transactions to be processed once certain parameters are met.

Triggers can be buy or sell orders (aka limit orders) that are automatically fulfilled when a pre-specified price is met (aka threshold). This allows you to automatically mint, redeem or shift a position at a pre-specified price and is only executed when when the asset in question reaches that price.

Triggers such as stop losses can also be used as risk management tools. For a short position, a stop loss order is set to above the current market price and it will be triggered if the price rises above that level, hence managing the downside risk whilst being exposed to the upside.

When setting a trigger you have four variables to consider:

- The input token that will be removed from your wallet. For a mint transaction this will be stablecoin collateral. For shifts and redeems it will be a long or short Float token representing an open position.

- The output token that you will receive when the transaction executes. For mints and shifts this will be a long or short Float token. For redeems it will be stablecoin collateral.

- The price at which you want the action to trigger.

- Above / below – by clicking the symbol next to the price field you can determine whether you want your action to trigger when the price received is greater than or equal to, or less than or equal to, your trigger price.

Triggers can be set up two ways in the UI:

- Markets Page in the Morgan mode view

- Profile Page on existing positions

Example scenarios#

For example, if the BTC market had a sharp upward price movement / price increase, and you believe that the price of BTC will subsequently have a sharp price decrease / downward price movement, you could configure a trigger to mint a 3x SHORT BTC position using stablecoin collateral, when the price of BTC drops below your trigger price.

Another example scenario for a trigger:

You have an open long BTC position in Float, but you want to protect yourself against downward price movement. You can create a stop order to redeem your long BTC tokens for collateral when BTC drops below a given price. If the oracle supplies a price meeting your given threshold, a redeem transaction will be submitted for your long BTC position.

Alternatively, you could have set up a similar trigger, but instead of redeeming your BTC long position, you could have shifted your BTC long position into a BTC short position.